Day 3 + the difference between 9/24/19 and 1/9/2020

Happy New Year. It’s been a while.

I started this 3 ish months ago knowing I would probably stop posting every day (because I tend to burn out). But thankfully, money’s always growing and the market’s always changing.

So here’s the 1/9/2020 update.

Pretty decent, huh? Keep in mind that these positions may be only several weeks, maybe several months’s old. The longest position is the gold position, for sure.

Some callouts before I break down each part of the portfolio:

This is “Money Weighted” return, not strict return. This is because, in scenarios where you add money to a position, it lowers the “strict” return. I don’t know the proper terms for these concepts, so I hope I’m making some sense. So yeah, 35.41%. Also, I’m up 27.29% in 2019, just 1.6% shy from the SPX return of 28.88%. So, pretty decent, but not good enough.

The 2020’s will be the decade that I beat the market.

Now, on to each holding, starting from the top:

USD Hedge ($GLD 18%, $SLV 12%)

I’ve been in this “USD Hedge” position (30%) the longest. It’s mostly precious metals, 60/40 gold/silver etfs. They have high expense ratios (I think $GLD has a .4% expense ratio, compared to VTI or other vanguard etfs of .08% or something). But it’s 30% of my portfolio, as I treat this as my “cash” position with some speculation that these precious metals’ value will rise as the entire world’s central banks are easing rates and pumping money into the system. The US Federal Reserve is the last beacon for safe money, and the Fed will probably continue lowering rates from 1.5% to 0. I don’t want to say this will happen in 2020, but they’re running out of room to cut rates during a downturn, which will drive up the price of gold and silver.

Of course, all speculative. NEXT

Altria ($MO 10%)

I love the $MO stock. It’s a “sin” stock, because they own parts of a alcohol, vaping, and weed company. Plus they’re traditionally a cigarettes company (Marlboro, I believe). Their dividend yield is nice, they’re at 6.71% div yield as the time of this writing. Plus they were at a low, roughly $40 which is where I bought in to it at.

I’ve recently decreased this position in my portfolio (from 25% to 10%) over the past couple weeks because I wanted to take some profits, and I wanted to make more room for the rest of my portfolio.

Twitter ($TWTR 10%)

Twitter is great, they’re at a nice low and have rallied nicely since I’ve bought in at $30.66. They haven’t benefited from the same 2019 tech rally as the tech giants $FB, $GOOGL, etc. They actually fell from $45, so I’m probably going to take half the position off at some point between now and $45.

Vanguard’s Emerging Markets ETF ($VWO 10%)

Dollar weakens, Emerging markets strengthen (generally)

Gold Miner’s ETF ($GDX 10%)

This is my extra speculative bet that gold prices will rally, as suppliers of gold will rally higher than the price of gold as it increases. Sector play, but speculative because it depends on if gold prices will rise. It’s almost like a leveraged gold position, because if gold rallies 10%, the gold sector (gold suppliers) will rally 15-20%. I can explain this later, too tired now.

VIX Futures ETN ($VIXY 10%)

I’m a fkn degenerate

Funko Inc. ($FNKO 10%)

They’re at a nice low, and I think they might see a rally when they announce earnings in a couple weeks. Holiday season, these were a great gift, they’ll show great revenues. Probably. Idk.

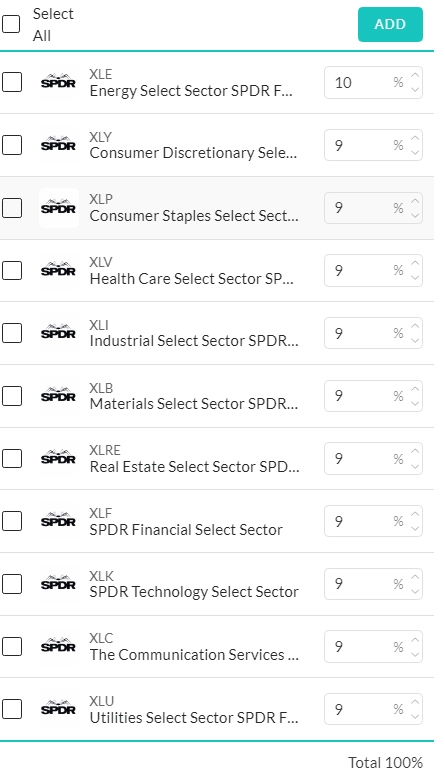

XOP and XLE (im getting tired, both of these comprise 10%)

These are sector ETFs as a speculative play that oil’s price rallies off the back of increased tension in the ME. I bought in because $WTI was at a nice low but I don’t invest in oil as a commodity, but I’m holding onto them now that this whole Iran stuff is going on. Not going to go into it much further than - I really thought the Strait of Hormuz was going to become restricted again, but I realize they won’t do that because it hurts their economy, too. So now I’m holding onto this because, why not

Happy 2020. Let’s see what this decade brings.